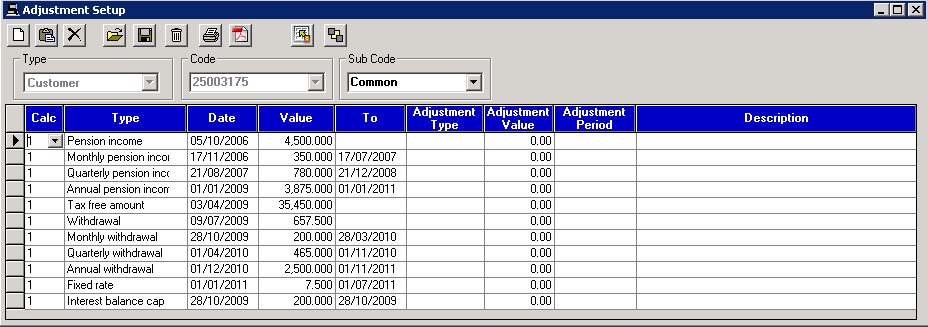

A portion of the Pension related adjustments differ from the Investments. Therefore if a Pension Related case is created the adjustments made available will be specific for that type, although some remain the same. The available adjustments are as shown in the diagram below:

* The System Generate icon is not available in the adjustment setup for a Pension related case.

Please note that descriptions can be added where required, however where not used the ‘Type’ will show on all printed results.

Pension income

Used for a single Pension Income provided to the customer through an annuity. This adjustments works in the same way as the Investment adjustment

Monthly pension income

Used for Pension Income provided to the customer through an annuity, on a monthly basis. This adjustments works in the same way as the Monthly Investment adjustment

4 weekly pension income

This adjustment is same as above but on a 4 week basis. Enter the start date, the value and the end date (For example, 4 months can be entered as ‘4m’).

Quarterly pension income

This adjustment is same as above but on quarterly basis. This adjustment works in the same way as the Quarterly Investment adjustment

Annual pension income

This adjustment is same as above but on an annual basis. This adjustment works in the same way as the Annual Investment adjustment

Tax free amount

Used for a single Tax Free Amount given to the customer from their pension.

Withdrawal

If a withdrawal was made by the customer, enter this adjustment using the specific date that the withdrawal was made and enter the amount that was taken out.

Monthly withdrawal

If a monthly withdrawal was made by the customer enter the date ‘From’ that the payments were taken out and the ‘To’ date where the withdrawals ended.

4 weekly withdrawal

This adjustment is same as above but on a 4 week basis. Enter the start date, the value and the end date (For example, 4 months can be entered as ‘4m’).

Quarterly withdrawal

Works in the same way as the monthly and annual withdrawal but allows the user to enter withdrawals that the customer made on a quarterly basis.

Annual withdrawal

Same idea as the monthly withdrawal but allows the user to enter any withdrawals that the customer made on an annual basis.

Fixed rate

A rate adjustment (for interest purposes) may be required for a set period within a calculation therefore this adjustment has been added to allow for that requirement.

Interest Balance Cap

When required, this adjustment ensures that interest is refunded on the correct amount.

Admin Fee

An admin fee is usually paid at the start of a loan or investment and this affects the Current Position (balance). Enter the date that it took effect and the value.

Monthly admin fee

This adjustment is same as above but on a monthly basis. Enter the start date, the value and the end date (For example, 4 months can be entered as ‘4m’).

4 weekly admin fee

This adjustment is same as above but on a 4 week basis. Enter the start date, the value and the end date (For example, 4 months can be entered as ‘4m’).

Monthly accrued admin fee %

This adjustment is calculated based on the previous months balances. This is only for Fund related calculations and not interest related calculations.

Quarterly admin fee

This is same as the Monthly and Annual Admin Fee but done on a quarterly basis. Enter the date it took effect from, the value and the date it ended.

Annual admin fee

Annual admin fee is paid on a yearly basis. Enter the date it took effect from, the value and the date it ended (For example, 2 years can be entered as ‘2y’).

Annual admin fee %

Annual admin fee is paid on a yearly basis. Enter the date it took effect from, the % of the balance for the fee and the date it ended (For example, 2 years can be entered as ‘2y’).

Tax %

Change tax % applied to interest calculations

Advisor fee

This is a positive adjustment for use where a one-off advisor fee has been charged

4 weekly advisor fee

This is a positive adjustment for use where a 4 weekly advisor fee has been charged

Monthly advisor fee

This is a positive adjustment for use where a monthly advisor fee has been charged

Quarterly advisor fee

This is a positive adjustment for use where a quarterly advisor fee has been charged

Annual advisor fee

This is a positive adjustment for use where an annual advisor fee has been charged

Set current position

This adjustment should be used to acknowledge the end position of the pension. The ‘From’ date will be the last day of the calculation. The Set Current Position adjustment will override other adjustment (withdrawal or income) on the same day as the position set must be that which is required.

GMP date (To)

This is used to set the To date that will be used to find the rate value when using the 148 (or similar) table. The adjustment To date should be set to that of the tab using the relevant table.

GMP retirement age

This can be used to override the retirement age defined by the customer’s gender (65 – Male, 60 – Female). The from date should match that of the relevant tab’s from date.

Related Topics