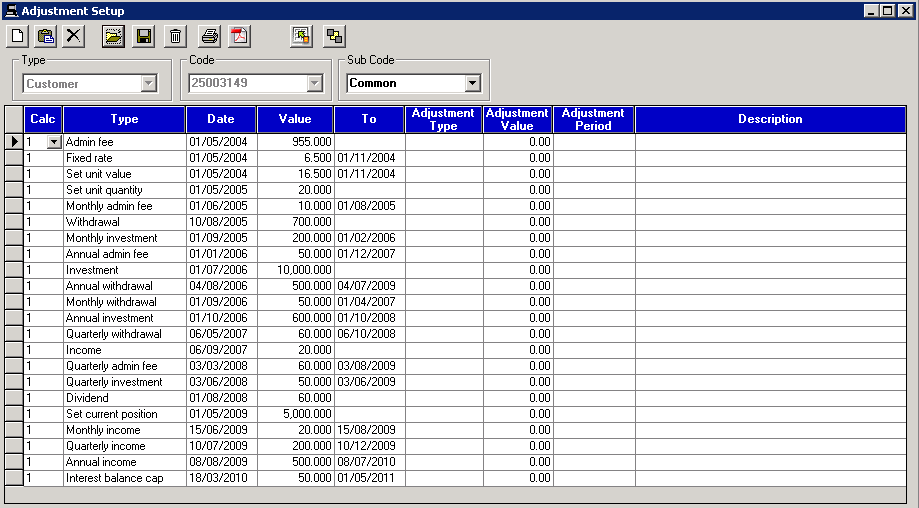

The diagram below shows the adjustments available in an Investment related case.

* The System Generate icon is not available in the adjustment setup when an Investment related case has been created.

Please note that descriptions can be added where required, however where not used the ‘Type’ will show on all printed results.

Admin fee

An admin fee is usually paid at the start of a loan or investment and this affects the Current Position (balance). Enter the date that it took effect and the value.

Monthly admin fee

This adjustment is same as above but on a monthly basis. Enter the start date, the value and the end date (For example, 4 months can be entered as ‘4m’).

4 weekly admin fee

This adjustment is same as above but on a 4 week basis. Enter the start date, the value and the end date (For example, 4 months can be entered as ‘4m’).

Monthly accrued admin fee %

This adjustment is calculated based on the previous months’ balances. This is only for Fund related calculations and not interest related calculations.

Quarterly admin fee

This is same as the Monthly and Annual Admin Fee but done on a quarterly basis. Enter the date it took effect from, the value and the date it ended.

Annual admin fee

Annual admin fee is paid on a yearly basis. Enter the date it took effect from, the value and the date it ended (For example, 2 years can be entered as ‘2y’).

Annual admin fee %

Annual admin fee is paid on a yearly basis. Enter the date it took effect from, the % of the balance for the fee and the date it ended (For example, 2 years can be entered as ‘2y’).

Investment

If a one off investment was made by the customer, enter the amount alongside the date that they made the payment.

Monthly Investment

If the customer made a monthly investment, enter the From date and To date to show the period they made the payments and enter the correct amount.

4 weekly investment

This adjustment is same as above but on a 4 week basis. Enter the start date, the value and the end date (For example, 4 months can be entered as ‘4m’).

Quarterly investment

As with the monthly and annual investment this adjustment allows the user to enter investments that the customer has made on a quarterly basis.

Annual investment

As with the monthly investment this adjustment allows the user to enter any investment that the customer made within a given period, but annually.

Income

This is a single income that the customer received and should be entered by adding the amount alongside the date that they received the amount.

Monthly income

If the customer received a monthly income from their investment, enter the From date and To date to show the period they made the payments and enter the correct amount.

4 weekly income

This adjustment is same as above but on a 4 week basis. Enter the start date, the value and the end date (For example, 4 months can be entered as ‘4m’).

Annual income

As with the monthly investment this adjustment allows the user to enter any income paid on an annual basis

Quarterly income

As with the monthly and annual income but done on a quarterly basis

Withdrawal

If a withdrawal was made by the customer, enter this adjustment using the specific date that the withdrawal was made and enter the amount that was taken out.

Monthly withdrawal

If a monthly withdrawal was made by the customer enter the date ‘From’ that the payments were taken out and the ‘To’ date where the withdrawals ended.

4 weekly withdrawal

This adjustment is same as above but on a 4 week basis. Enter the start date, the value and the end date (For example, 4 months can be entered as ‘4m’).

Annual withdrawal

Same idea as the monthly withdrawal but allows the user to enter any withdrawals that the customer made on an annual basis.

Quarterly withdrawal

Works in the same way as the monthly and annual withdrawal but allows the user to enter withdrawals that the customer made on a quarterly basis.

Please note that the Withdrawal adjustment will affect the balance at the point that it occurred. This differs from an Income adjustment which is displayed in the rework, however it does not show on the account until the end, where the total of the incomes are removed from the final balance in the comparison screen.

Set unit value

This adjustment sets the unit value for a given period. Enter both the From and To date (exclusive).

Set unit quantity

Enables the user to set the unit quantity within the system by adding an adjustment on the date that they wish to specify the unit amount from.

Set current position

This adjustment should be used to acknowledge the end position of the fund in question. The ‘From’ date will be the last day of the calculation. The Set Current Position adjustment will override other adjustment (withdrawal or income) on the same day as the position set must be that which is required.

Unit change

This adjustment adds or removes units based on the current unit value. The net effect is an increase or decrease of the balance.

Dividend

Where dividends are required the details on the main screen will filter through into the case. This adjustment allows the user to specify the actual dividend payment amount at a given time. Each dividend must be entered on an individual basis, e.g. one adjustment per payment.

Please note that cases which include dividends require external information to be accessed. Therefore we recommend that delegates attend our Investment Related Training course in order to fully comprehend the capability of the system.

Fixed Rate

A rate adjustment (for interest purposes) may be required for a set period within a calculation therefore this adjustment has been added to allow for that requirement.

Interest Balance Cap

When required (for Credit Card Payment Protection Insurance cases) this adjustment ensures that interest is refunded on the correct amount.

Tax %

Change tax % applied to interest calculations

Annual Dividend %

This adjustment allows a dividend % to be applied on an annual basis. This is based on the fund value.

Annual unit change %

This adjustment changes the amount of units by the percentage specified on an annual basis, thereby increasing the fund value.

Advisor fee

This is a positive adjustment for use where a one-off advisor fee has been charged

4 weekly advisor fee

This is a positive adjustment for use where a 4 weekly advisor fee has been charged

Monthly advisor fee

This is a positive adjustment for use where a monthly advisor fee has been charged

Quarterly advisor fee

This is a positive adjustment for use where a quarterly advisor fee has been charged

Annual advisor fee

This is a positive adjustment for use where an annual advisor fee has been charged

Monthly accrued fee %

This adjustment calculates a monthly fee based on Tiered percentages, using the previous month’s daily data using the system generator. The adjustment is intended for use purely within the system generator but it will create values in normal use. This adjustment makes the system break periods on a daily basis as it needs daily balances to calculate the monthly accrued fee.

Please note that some compound interest values will not be completely accurate when viewing on screen as this adjustment is for use with the system generator.

Related Topics