Scenario

Customer took out a repayment mortgage for £85,000 in 2000 on a fixed rate of 5% but when checking his statements in April 2009 the rate being charged was 6.50%. After further investigation it was established that the customer was put onto the wrong fixed rate product.

|

Lender |

Halifax |

|

Mortgage |

£85,000 |

|

Start Date |

10th February 2000 |

|

First Payment |

10th March 2000 |

|

End Date |

1st May 2010 |

|

In MIRAS |

Yes |

|

Term |

25 years |

|

|

|

|

Fixed rate |

6.50% for 10 years - applied |

|

|

|

|

Fixed rate |

5% for 10 years - should have been used |

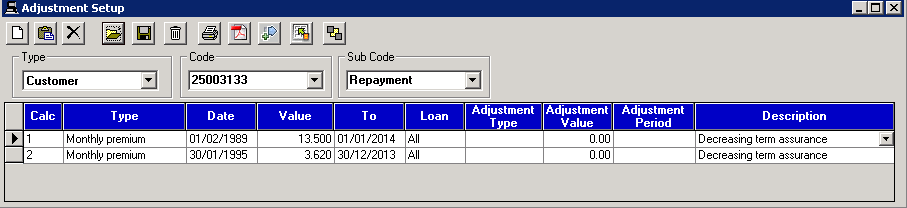

Set-up two adjustment sets:

1) ‘FixRate1’ with a 6.50% fixed rate for 10 years, starting on 10th February 2000 (Enter 10y for the ‘to date’)

2) ‘FixRate2’ with a 5% fixed rate for 10 years, starting on 10th February 2000 (Enter 10y for the ‘to date’)

Select the lender and interest rate for the ‘Halifax’ and select repayment for both the actual (A) and notional (B) calculation types, entering a term of 25 years. Select ‘FixRate1’ for the actual adjustment (A) and ‘FixRate2’ for the notional (B) adjustment.

Comparison Screen

Observations

1. The payments are lower, as expected

2. Balance is lower when interest rate is lower. This may not be expected but is correct.

3. Redress is a result of higher outgoings and a lower balance.

Related Topics